Strategic Oversight and Risk Control

The board defines the company’s risk appetite, setting the tone for an integrated approach. Our framework focuses on identifying, assessing, and controlling risks while monitoring their impact—helping businesses reduce both the likelihood and impact of potential threats.

Pure risk combines the likelihood of events with their consequences, providing a foundation for strategic planning. Measuring such risks involves more than just tracking volatility—it requires deeper analysis. Uncertainty, however, adds complexity, as outcomes become less predictable and more subjective. In these cases, taking precautionary steps is essential to safeguard against unknowns.

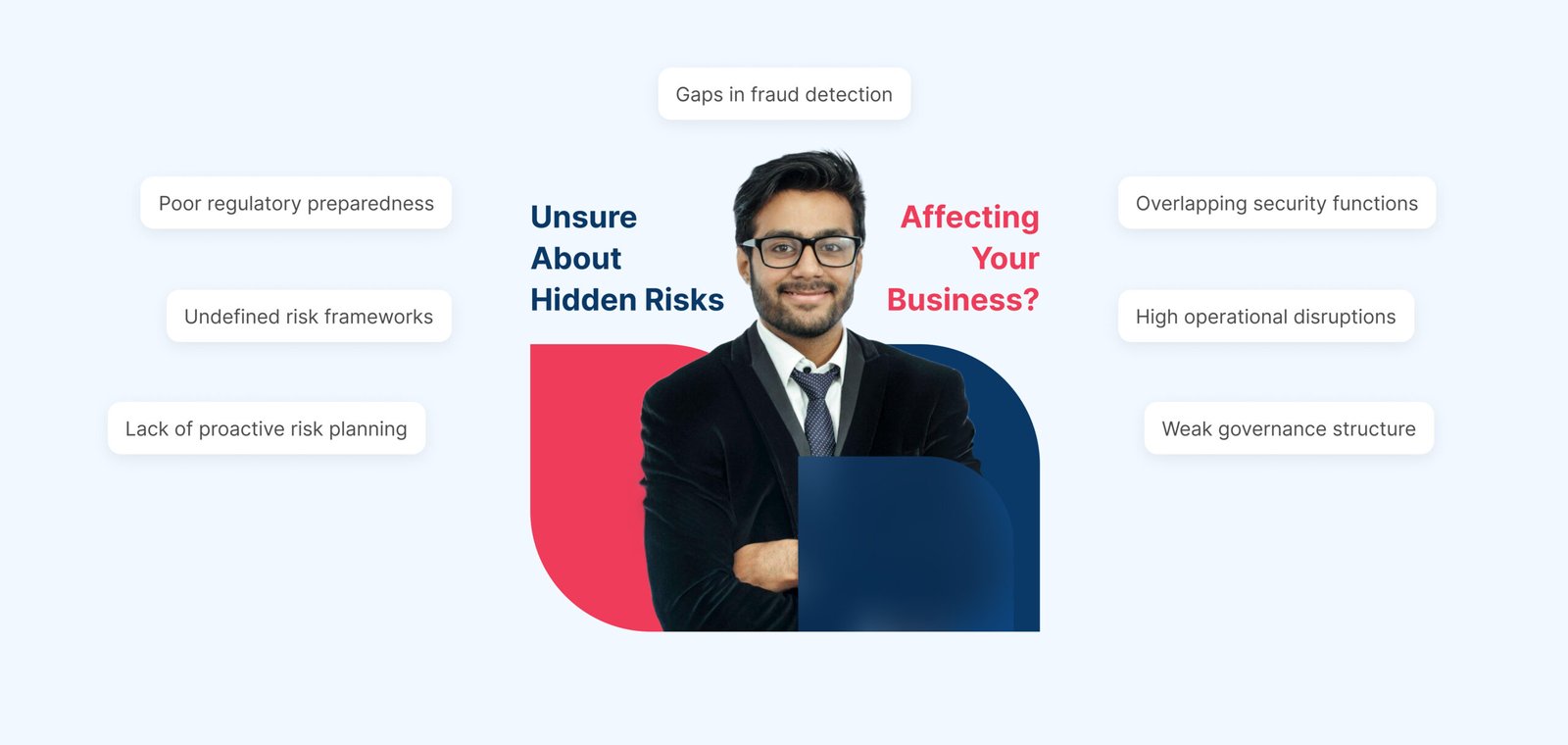

Our Corporate Risk Management service is designed to help organizations proactively identify, assess, and manage strategic, operational, financial, and compliance risks. By implementing structured frameworks and control measures, we enable businesses to navigate uncertainty, protect assets, and support long-term growth. Our approach integrates risk evaluation, monitoring, and mitigation to ensure stability and informed decision-making at every level.

Key Risk Categories in Corporate Risk Management

Understanding and managing these five critical types of risk is essential for maintaining business resilience and operational stability:

Pure Risk

Refers to risks that are typically insurable and often predictable, involving losses only—such as natural disasters or accidents—frequently influenced by moral hazard or adverse selection.

Liquidity Risk

The threat of not being able to meet short-term financial obligations due to insufficient cash flow or limited access to funding, which can disrupt operations and stakeholder confidence.

Market Risk

Involves potential financial losses resulting from fluctuations in market variables like commodity prices, exchange rates, and asset valuations.

Default Risk

The likelihood of a borrower or counterparty failing to meet debt obligations, including uncertainties related to recovery rate and exposure at the time of default.